The Curran Knittle Group provides comprehensive financial planning and customized investment management for a variety of investors, business owners, and families.

The Curran Knittle Group provides comprehensive financial planning and customized investment management for a variety of investors, business owners, and families. Jim and Monty have a specific focus on Special Needs Financial Planning. Through our experiences, we have accumulated a wealth of knowledge enabling us to navigate our clients through the complexities of Special Needs Planning.

Jim and Monty have more than 50 years of cumulative, extensive, personal, and professional experience. Jim is a Certified Financial Planner and Monty is a Chartered Financial Analyst Charter holder, which is a unique combination of professional degrees that we believe help us to better service our clients.

Understand Who You Are + What You Want = Deliver a Personalized Plan

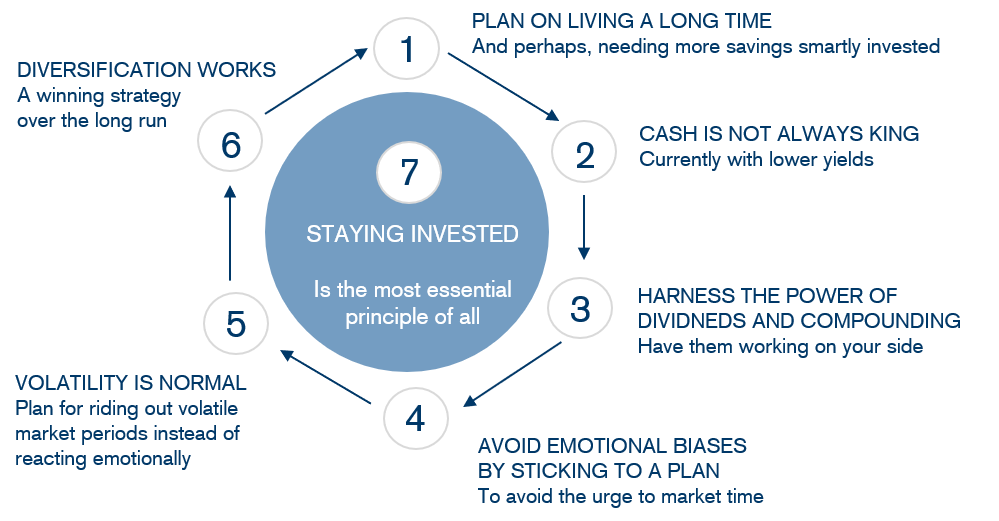

We start by sitting down with you and through a series of substantive conversations; we learn about your values, priorities, concerns, and the goals you would like to achieve. We use the results of those discussions to create a personalized wealth management plan and an investment strategy to enable you and your family to realize your goals.

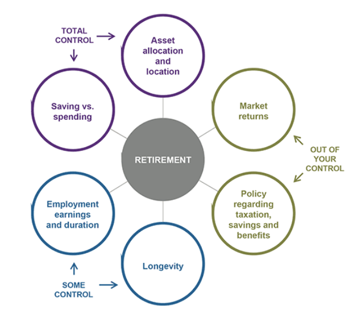

Stress test your goals against market, longevity and inflation risk given your resources

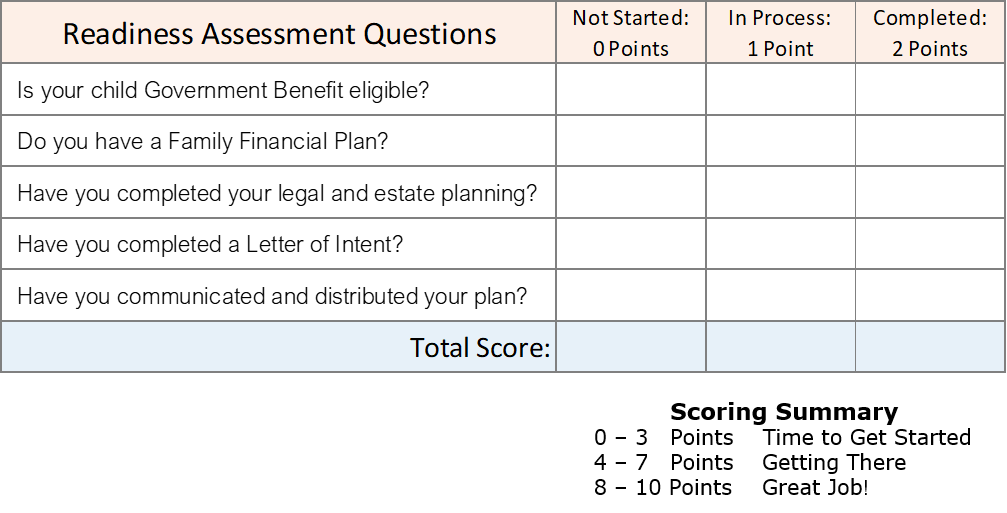

Planning for the future of an individual with special needs requires preparation, careful research and experienced professional guidance. Parents or grandparents planning for the financial well-being of a special needs individual face several challenges.

Financial Advisor, Managing Director

Vice President,Portfolio Manager

CFP®, CRPC®

Associate Vice President, Senior Client Relationship Manager

Associate Vice President, Senior Client Relationship Manager

© 2022 Copyright by Harbor Investment Advisory, LLC

All rights reserved to site content. Website by PinkPoint Media